Understanding Health Insurance Types

Posted in Uncategorized on January 21, 2019

When shopping for health insurance for you and your family, you’ll generally have choices. Whether you buy from your state’s health care market, an independent insurance broker, or through your employer, there are lots of options. Choosing the plan that’s right for you and your family is important, and not as simple as one may believe.

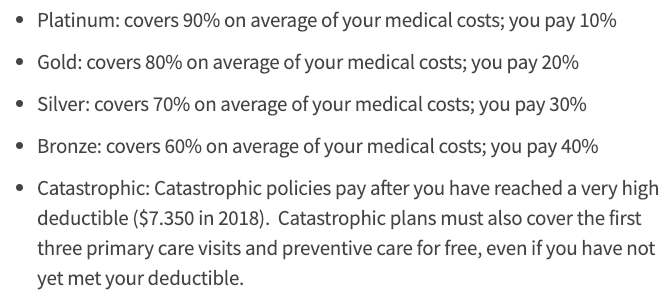

Levels of Coverage

Typically, you will choose a level of coverage that your plan offers. Bronze, silver, gold, and now even platinum are examples of options available. While a bronze plan offers the smallest amount of coverage, platinum will have the biggest. For people under 30, there is a high-deductible, catastrophic plan they may qualify for. Finding a doctor that accepts your insurance is a must, as well.

Each plan covers a pre-determined share of the cost for the median enrollee. Details can get very granular on what is and is not covered, and can and will vary with differing plans. The deductible is the amount you must pay before the health insurance plan starts picking up 100% of your care costs. These can also vary based on which plan you choose. The general rule of thumb is the lower the price, the higher the deductible, though there are exceptions. All things considered, preventative care is usually 100% paid for regardless of a met deductible.

attribution: webmd.com

Components of Health Insurance Costs

Premium – This is the amount you pay monthly, quarterly, etc. for your health plan.

Deductible – This is the amount you must spend before your plan makes payments on your behalf, though you’ll still be charged 20% or similar, based on your chosen plan.

Copay – This is your portion of an office visit or prescription fee. Generally, $25 to $50, but can vary greatly depending on the type of plan. This could also be an ER visit

Out of Pocket – Some plans have an out of pocket maximum that is a maximum you’ll be required to pay during a calendar year. After it’s satisfied, all fees of any sort are covered. Again, this can vary by plan and is usually a larger number the smaller your premium is.

Different Types of Plans

Common types of insurance plans are HMO, PPO, POS, EPO, and HDHPs. Along with these, there is also the added benefit or option of HSA or HRA. The two most common types of insurance in America are HMO and PPO.

HMO

Health Maintenance Organizations, or HMOs offer kind of an all-in-one service. They often require you to use providers that are in their network to receive care, instead of choosing your doctor. Historically, referrals (from primary care physician to specialist, and so on) are a large part of HMO plans. Going outside of your network usually ends up costing you big time because it likely isn’t covered at the same rate. With an HMO there will be fewer forms to fill out, but also fewer personal choices in physicians.

PPO

Preferred Provider Organizations (PPO) offer a great deal more freedom in choosing your family doctor. This can be a huge win for PPO policyholders because your doctor is very important and personal to you. Though you’ll still have a network to choose from, there is a lot more leniency. While there is more freedom, there is often a lot more paperwork and higher costs for choosing out-of-network providers. Another advantage is that very few referrals are required for specialist visits.

EPO

An Exclusive Provider Organization, or EPO, is exactly that – exclusive. Well, the care covered is exclusive. While the premium for an EPO is more affordable than that of an HMO or PPO, the options for care are more limited, and for that reason. Expect very little paperwork with an EPO, but also keep in mind there is zero coverage outside of your network. Emergency services may be covered in part or whole based on the provider of the EPO.

POS

A POS plan combines some of the elements of both PPO and HMO plans. Some POS plans require you to meet your deductible before they start covering your care costs. Out-of-network providers are often covered, but you must pay them upfront and then be reimbursed. With a POS you have the choices comparable to that of a PPO, but the higher cost associated with HMO plans.

HDHP

A low-premium alternative is a High Deductible Health Plan. Like all plans, there are good and bad features to this one as well. Once you reach your deductible, all costs are covered, but deductibles are quite high (individual – $1,350 to $6,650; family – $2,700 to $13,300). These plans are sometimes paired with HSA (health spending account), and you can use the money from your HSA to help pay for fees until you’ve met your deductible.

Catastrophic

Unlike all of the other plans mentioned, a catastrophic plan is only for individuals under the age of 30. It covers (usually) emergency care, (always) preventative care, and (up to 3) primary care visits before the deductible applies. The deductible for an individual is $7,350 and $14,700 for a family. The high deductible is the tradeoff with the low premium. After the deductible is met, all medical costs are covered.

Bonus: Health Reimbursement Account

A health reimbursement account is an addition to certain plans like HMOs or PPOs that allows you to earn incentive credits. Depending on what your specific health insurance plan offers, you can get incentive credits for biometric screenings, health coach calls, filling out real age tests, and other tasks. Once earned, the points go into an account and are actual dollars. The insurance company will then cut you checks for money you’ve spent (copays for office visits, prescriptions, etc) until that HRA is exhausted.

Curious about what plan is best for you? Talk to your employer’s HR department if they offer health benefits, contact an independent insurance broker, or go to healthcare.gov to choose a plan that’s right for your family’s needs.